Defense Secretary James Mattis has called for relief to North Korea to only come after it takes “irreversible steps to denuclearization.”

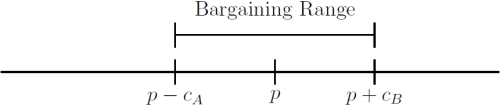

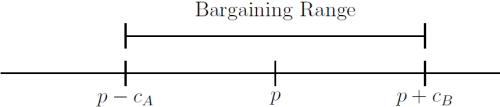

Let’s set aside the question of whether this will happen. It probably won’t. The United States cannot credibly commit to not invade a nuclear-free North Korea under the right circumstances, and so North Korea will keep its deterrent to hedge against that. And even if that credible commitment were not a concern, the ability to build nuclear weapons drives concessions. North Korea would not agree to “irreversible” denuclearization if only to maintain its ability to leverage the threat to build again.

Instead, let’s focus on a more interesting question: can you make nuclear proliferation irreversible? This is difficult to answer because you first need to somehow quantify a state’s nuclear proficiency. One cannot observe proficiency directly, only behaviors consistent with low or high proficiency.

Fortunately, Brad Smith and I have developed a measure of this. ν-CLEAR takes observable nuclear behaviors and uses that information to estimate a country’s nuclear proficiency. We are currently working on a massively expanded version of the data, and one of our findings speaks to the situation with North Korea.

Consider the role of uranium enrichment and reprocessing on nuclear proliferation. This is a critical step toward actually building a nuclear weapon. Bombs need fuel, and to have fuel you need to either enrich uranium or reprocess plutonium from spent uranium. The Yongbyon Nuclear Scientific Research Center has such a facility. Any deal like what the Trump administration hopes for would involve shutting this down.

However, shutting down a facility does not necessarily make nuclear proliferation irreversible. Unless actually operating an enrichment or reprocessing facility radically shifts a country’s nuclear proficiency, North Korea could just construct a new one.

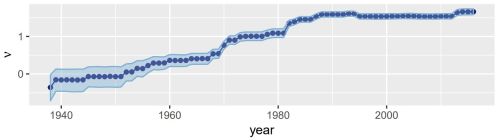

Our data and a little bit of historical knowledge can help us understand the relationship between fuel facilities and nuclear proficiency. Argentina operated its Pilcaniyeu Enrichment Facility until 1994. Let’s look at a timeline of Argentina’s nuclear proficiency before and after. Larger values mean greater proficiency:

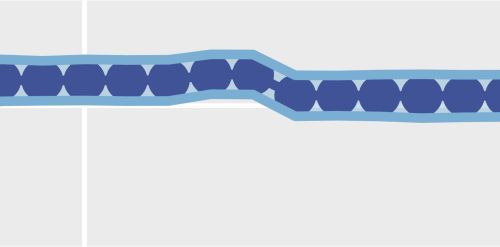

Closing the facility had an effect. But it’s marginal. Let’s zoom in on 1994:

Argentina’s proficiency score definitely drops. However, operating the facility is only of marginal importance.

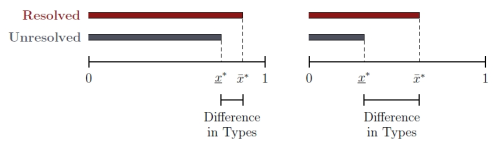

What is going on here? The issue is that having a facility and knowing how to create a facility are two different things. A country that builds fuel fabrication centers also has the nuclear capacity to engage in other nuclear activities. Our estimation procedure incorporates those factors into a state’s overall score. When a state shuts down those facilities, the procedure penalizes that state’s score. But it also recognizes the state’s other nuclear activities as evidence of its ability to rebuild a facility if it wanted to. As a result, ν does not believe that operation of the facility tells us much about what Argentina can or cannot do.

Bringing this back to North Korea, it is unlikely that any sort of divestment will irreversibly cancel North Korea’s nuclear weapons program. For these purposes, knowing how to do things is more important than actually doing them. As long as North Korean nuclear scientists retain their knowledge, Peongyang will always be able to restart the program.

As a final note, to be clear, I am not suggesting that the U.S. should ignore the importance of the Yongbyon Nuclear Scientific Research Center. When Donald Trump meets Kim Jong-un, it should be an important topic of discussion. The ν measure only captures what states can do. It does not care much about time delays. Shuttering Yongbyon would probably not reduce North Korea’s ability to develop more fuel. But it would increase the time necessary to do that because North Korea would have to rebuild the facility. And that’s a goal worth obtaining.